An Accounting Convention Is Best Described as

A chart of accounts is. In the adoption of accounting conventions the personal judgment plays an important role.

Principles Of Financial Accounting Ppt Download

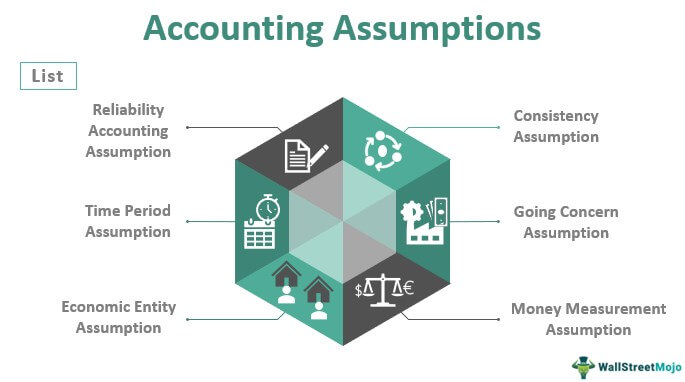

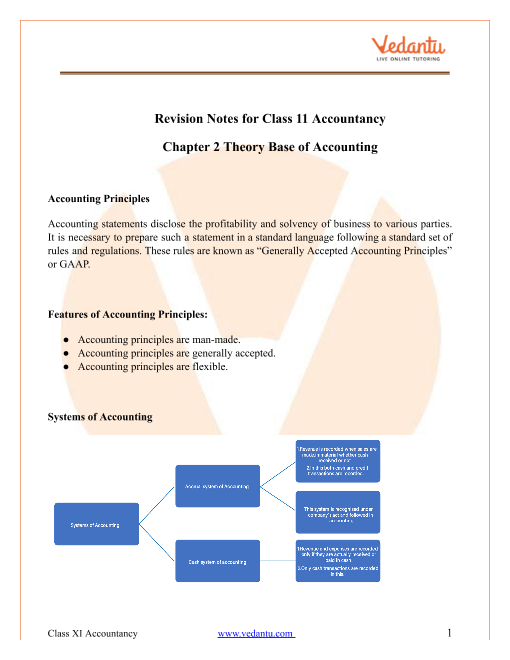

Accounting concepts refers to the rules of accounting which are to be followed while recording business transactions and preparing final accounts.

. If the accountants go on including the insignificant or those items. Accounting conventions are the guidelines based upon custom or usage or general agreement. The same as a trial balance.

These conventions are also known as doctrine. A simplied version of a T-Account. It is used when there is not definitive guidance in the accounting standards that govern a specific situation.

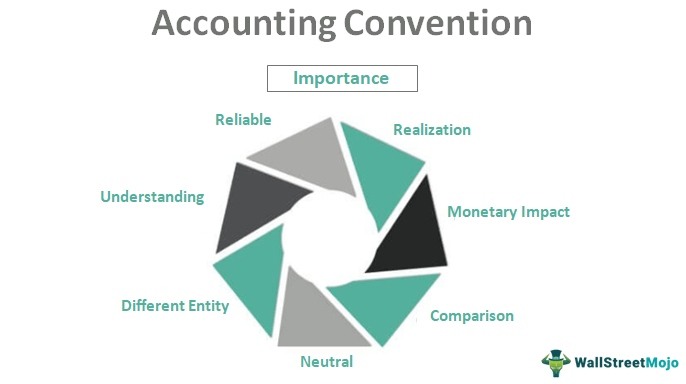

Accounting conventions are standards customs or guidelines regarding the application of accounting rules. Also known as accounting. Accounting conventions implies the customs or practices that are widely accepted by the accounting bodies and are adopted by the firm to work as a guide in the preparation of final.

According to this accounting convention two values of a transaction are available value which is lower among the two values is considered. This convention seeks to ensure that private transactions and matters relating to the owners of a business are segregated from transactions that relate to the business. An accounting convention is a common practice used as a guideline when recording a business transaction.

Something that cannot be changed. Also one should be conservative in recording the amount of assets and not underestimate liabilities. There is some kind of logic behind.

The result should be conservatively-stated financial statements. Accounting Concept vs Convention. It is to ensure that profit should not be overestimated and there must be some provision for the losses.

According to this convention only those events and transactions which are highly important and have an effect on the overall business should be considered while preparing the statements. To be clear these are nothing but unwritten laws. A listing of each general ledger account which is assigned a name and a number.

The accounting conventions are used while maintaining the financial statements by the common consent of the accountants. Realisation With this convention accounts recognise transactions and any profits arising from them at the point of sale or transfer of legal ownership - rather than just when cash actually changes hands. Under the prudence concept do not overestimate the amount of revenues recognized or underestimate the amount of expenses.

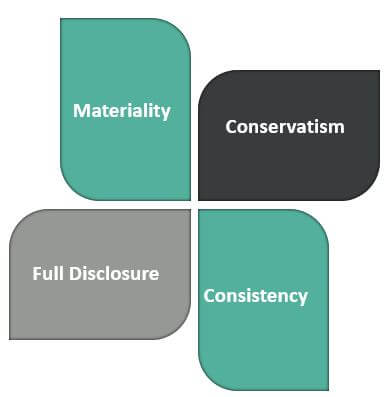

There are four widely recognized accounting conventions that guide accountants. An accounting convention is a practice generally followed by all accountants as a result of custom although changing norms in the accounting and financial industries result in periodic updates to them. An accounting convention is best described as-an absolute truth-an accounting custom-an optional rule-something that cant be changed.

The accounting convention of materiality is also the one which needs to be discussed. An accounting convention is best described as a. This convention says that it is better to show less income and resources rather than showing them overestimated.

Used only for balance sheet accounts. The main difference between Accounting Concept and Convention is that Accounting concepts are the rules and regulations of accounting while accounting convention is the set of practices discussed by the accounting bodies before preparing final accounts. The accounting concept is a theoretical statement.

The owners have limited liabilityDefinition. An accounting convention is best described as a. The accountants have to adopt the usage or customs which are used as a guide in the preparation of accounting reports and statements.

What is an Accounting Convention. The main difference between Accounting Concept and Accounting Convention is that Accounting concepts are the essential accounting assumptions that act as a ground for recording business transactions and preparation of final accounts and Accounting conventions are the techniques and procedures which have universal acceptance. An accounting convention is best described as an accounting custom An accountant has debited an asset account for 1200 and credited a liability account for 500.

Its profits are taxed on the owners personal tax return. An accounting convention consists of the guidelines that arise from the practical application of accounting principles. Thus accounting conventions serve to fill in the gaps not yet addressed by accounting standards.

In other words play it safe. Conventions denote customs or traditions or usages which are in use since long.

Difference Between Accounting Concept And Convention With Table Ask Any Difference

Accounting Concepts Principles Powerpoint Slides

What Is Accounting Definition And Meaning Of Accounting

Accounting Convention Meaning Examples Types

Difference Between Accounting Concept And Convention With Comparison Chart Key Differences

Accounting Concepts Principles Powerpoint Slides

What Are Accounting Conventions What Are The 4 Accounting Conventions Wikiaccounting

Accounting Assumptions Definition List Of Top 6 Assumptions

Difference Between Accounting Concept And Convention With Table Ask Any Difference

Principles Of Financial Accounting Ppt Download

Principles Of Financial Accounting Ppt Download

Principles Of Financial Accounting Ppt Download

Principles Of Financial Accounting Ppt Download

Accounting Concepts Principles Powerpoint Slides

Accounting Concepts And Conventions Mcqs Financial Accounting Mcqs Part 2 Multiple Choice Questions And Answers

Accounting Convention Meaning Examples Types

Cbse Class 11 Accountancy Chapter 2 Theory Base Of Accounting Revision Notes

/GettyImages-951223478-61b12b0f3a5f4f53a5d35b753ff0327f.jpg)

Comments

Post a Comment